NEWS

New Services for CCMBC Employees

- Details

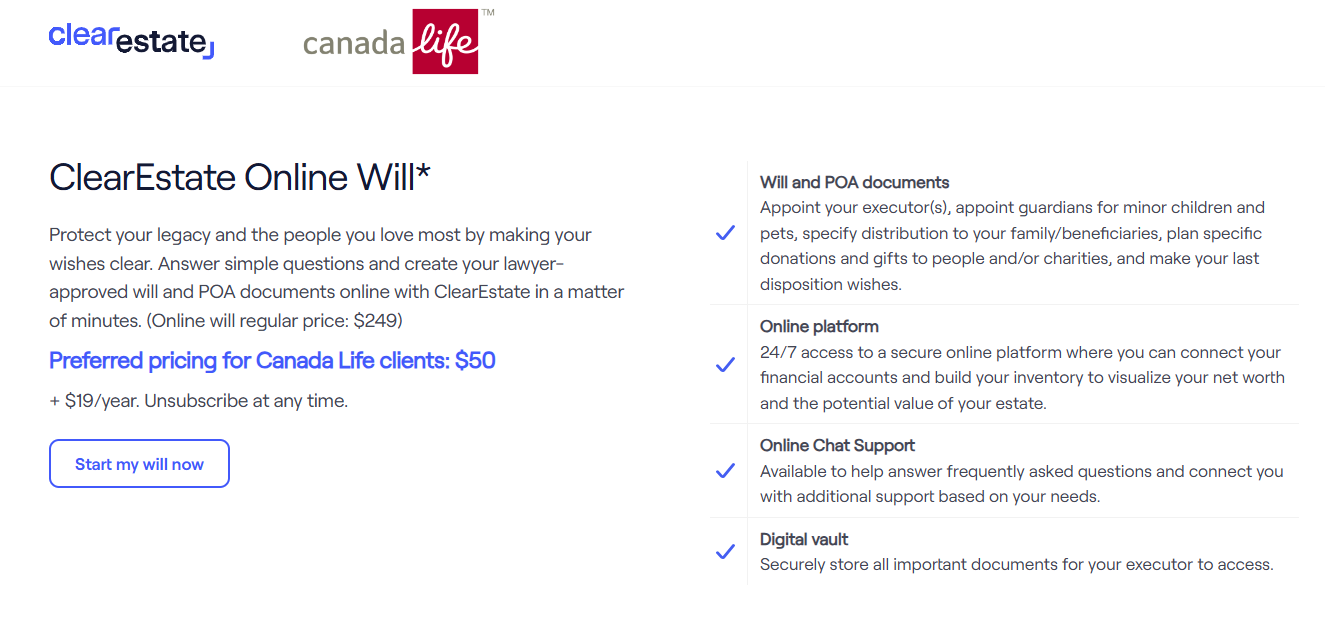

Affordable Online Will and Power of Attorney Services Are Now Available to CCMBC Employees and Their Families.

The CCMBC Benefits Plan, held with Canada Life, includes several offerings to help improve you and your family’s physical, financial, and mental well-being. Log in to My Canada Life at Work and explore “Options for you.”

As a CCMBC employee, you and your family have access to affordable will and power of attorney services through Canada Life, for as little as $50!

For more information about the CCMBC Benefits Plan, including our Employee and Family Assistance Program through Homewood Health, click HERE.

January 2025 Newsletter

- Details

View or download the July 2024 Newsletter

New HR Advisory Services for CCMBC Churches

- Details

We are pleased to announce our new partnership with Spraggs Advisory Group (“SAG”) to provide members with access to specialized HR Consulting Services. These advisory services are specifically designed to support churches and non-profits, recognizing the unique challenges and values that guide your mission. SAG’s HR advisors bring extensive experience in serving church’s and organizations just like yours.

Key Benefits of HR Consulting Services

Direct Access

CCMBC Members will have access to a direct email.

Below Market Cost

This partnership allows Members to access professional HR services below market cost.

Faith-Based Organizations Expert

SAG Consultants comes with years of experience working with faith-based organizations.

To learn more about our Faith-Based HR Consulting services, click here: Faith-based HR Advisory Services

Have questions? Contact us at This email address is being protected from spambots. You need JavaScript enabled to view it.

Joint Tenancy in Canada: Understanding the Benefits and Implications

- Details

Joint tenancy is a common form of property ownership in Canada, often chosen for its convenience and the legal benefits it offers. It is particularly popular among couples and family members who wish to share ownership of a property. Understanding joint tenancy, its advantages, disadvantages, and legal implications, is crucial for anyone considering this form of ownership.

To learn more, click here: Joint Tenancy in Canada

Questions? Our partners at Advisors with Purpose can help! Please contact them at This email address is being protected from spambots. You need JavaScript enabled to view it..

2025 TFSA Limit Announced

- Details

The TFSA contribution limit for 2025 has been officially released by CRA. The annual contribution limit for 2025 will be $7,000, matching the 2024 amount.

With the 2025 TFSA limit set, the total contribution room available in 2025 for someone who has never contributed and has been eligible for the TFSA since its introduction in 2009 is $102,000. If you are unsure of your available contribution room, please call CRA's Tax Information Phone Service at 1-800-267-6999.

If you would like to open a new TFSA or contribute to an existing TFSA with CCMBC Investments, please visit our Invest With Us webpage to learn how, or contact our office by emailing This email address is being protected from spambots. You need JavaScript enabled to view it. or calling 1-888-669-6575.